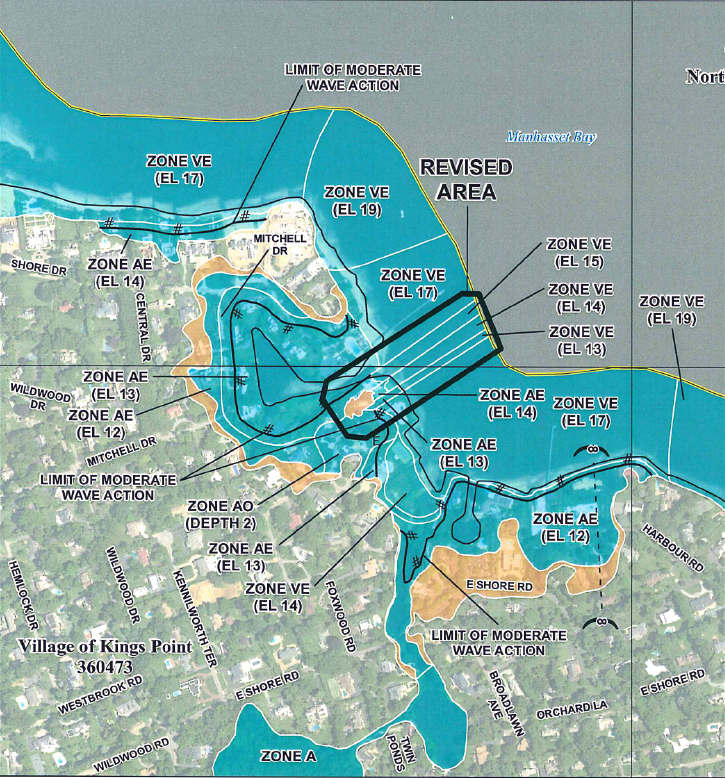

Walden was hired to revise the 2009 Flood Insurance Map (FIRM) for a property located on the North Shore of Long Island, NY. The property is in a Special Flood Hazard Zone (SFHA), with the house located in the mapped VE zone, which denotes a coastal high flood hazard area where developed is strictly restricted.. The property owner was facing two basic problems: 1. Restrictions on construction/development in the VE zone, and 2. High flood insurance rates. Walden evaluated available information and had conversations with NYSDEC, the Village and other members of the client team about the existing flood zone mapping for the property and neighboring parcels. We determined that the VE boundary was not accurate and prepared a submittal to FEMA to justify a LOMR. The Village agreed with Walden’s approach and the information was submitted to FEMA along with the property survey and other documentation supporting the request for map revision. FEMA provided comments and required coastal modeling related to support the proposed FIRM revisions.Based on our experience and knowledge of flood insurance studies (FIS), FEMA flood related projects, ArcGIS, and AutoCAD, etc., Walden was committed to achieving the best result, but did not guarantee the result until all of the detailed modeling was done and approved by FEMA.

The Federal Emergency Management Agency (FEMA) has detailed application/certification forms for revision requests or amendments to the National Flood Insurance Program (NFIP) maps. The majority of the application was related to the coastal zoning analyses where coastal transect modeling based on elevation map, seawall structure criteria, wave behavior and information, wave runup, and overtopping were considered. To be consistent with the FEMA model used in the Flood Insurance Study (FIS), Walden adjusted the coastal modeling input parameters for the new transects created for the property area. The transects profile data tables were generated using site specific station/elevation data from LiDAR and bathymetric contour maps (outside of the Property) and the survey contour map (within the Property) following the stationing rules of the model. Failed wall and scour calculations were also considered in delineating transect profiles based on conservative assumptions.

Walden had to coordinate with FEMA Flood Insurance Mapping representatives to finalize the coastal modeling and flood zone mapping. Revising the SFHA depending on the modeling results and engineering judgement and tie them into the existing flood zone boundaries outside the LOMR area, was the biggest challenge of the project. Walden’s LOMR application was successfully approved, achieving the desired FIRM zoning modification, shifting the VE zone boundary closer to the edge of the property, which will allow our client to proceed with planned renovations of his house. The approved LOMR reduced the restrictions for on-site construction and building code requirements, achieving the client’s goals.