The emphasis, interest and incentives for renewable energy facilities throughout the country has increased the proliferations of these types of new projects. This is great news for resiliency, cost savings and to reduce the continuance of changes to our climate. However, the mix of incentives, ownership models and community-minded goals has introduced questions and concerns regarding how these types of facilities should be valued and assessed for taxation and transaction purposes.

In New York State, incentives and benefits for clean energy projects have included many taxation approaches; but then the methods of assessing these projects’ values have varied. Similar potential issues have begun to immerge in other states, regions and the country. On October 13, 2021 in an effort to provide the first of clarity, the New York State Department of Taxation and Finance released a final appraisal methodology for solar and wind energy systems which would be used to perform value and place assessments for solar and wind energy systems. The model is intended to create a standard method of assessing solar and wind projects to give developers, investors and taxation officials a clear idea of the assessment protocols. The same protocols are expected to influence how other states and taxing jurisdictions consider their approach to assessment value and for future incentive programs.

What is the Appraisal methodology?

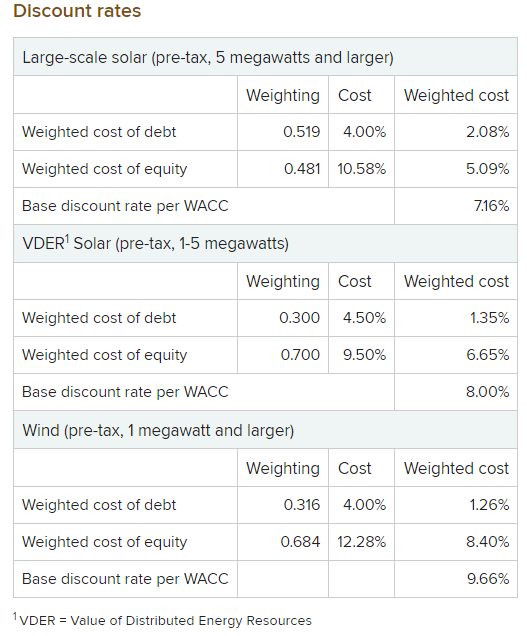

Each year the New York Tax Department will develop an appraisal model with discount rates. The models will be based on discounted cash flow (DCF) methodology. This methodology considers projects future cash flow, which is then discounted to produce the current assessed value of the facilities. The discount rate applied to the model is depended on the scale and type of project. For example, Figure 1 below shows the initial Discount Rates planned for New York.

Figure 1. New York Initial Discount Rates for Solar and Wind Facilities

All solar or wind energy systems in New York will be assessed using this methodology if the system’s capacity is equal to or greater than one megawatt.

What Does this Mean for Local and State Taxing Jurisdictions?

Taxing agencies will continue to have the flexibility to negotiate new payment in lieu of taxes (PILOT) agreements but existing PILOT agreements may be revisited. If the current PILOT considers future revenue in its assessment, it will most likely be unaffected. However, if it is based on the assessed value of the project from other methods such as cost-based or market-based approach–the PILOT may need to be amended because the assessed value is likely to change. Local and state units of government that own solar or wind facilities will continue to be fully exempt from taxation but still may want to monitor the assessed value of their investments. Also, the resulting tax exemptions will likely reflect a calculation based on DCF.

More Work and Analysis is on the way

There are still some adjustments expected to this taxing methodology. Many of these expected challenges were highlighted by a publication by Daniel Spitzer and Henry Zomerfeld at Hodgson Russ Attorneys LLP (Spitzer and Zomerfeld provide excellent content on this topic here which was helpful in the writing of this blog). By using DCF for the methodology, there are plenty of assumptions and complicated calculations that may or may not give an accurate valuation of a project. The model may produce valuations that are greater than the actual current value of the facility. Greater assessments result in higher taxes that the solar and wind facilities may not be able to afford.

Although there are limitations, there is still the benefit of using this methodology to assess projects taxable valuation prior to investment or construction completion. With the methodology getting reevaluated annually, many of these issues will likely resolve. Until the next iteration, it is recommended to approach this topic cautiously.

The new model and discount rates will begin to be utilized starting with the 2022 assessment rolls in New York but only to solar and wind facilities above one megawatt of capacity. Further guidance for smaller solar and wind facilities, energy storage systems and other alternative clean energy facilities will have to be addressed in future tax law. After some refinements of the model and discount rates, greater predictability and clarity of solar and wind facilities assessed values is expected.

Walden Can Help

Walden can navigate and provide guidance between the financial, income and cost-based valuation and assessment methodologies. Walden performs services that can help owners, investors and operators of these types of renewable energy systems protect the value, profitability or public benefit of these assets. Walden’s Business and Transaction Advisory Services Team is staffed with experts that have experience as engineers, in finance, performing valuations, and due diligence for public and private clients. Our Business and Transaction Advisory Team provides organizations with sound guidance related to business operations like achieving financial goals and overcoming taxation questions and challenges, as well as mergers and acquisitions, valuations, assessments and future impact studies.

If you need additional assistance understanding the new and emerging appraisal and assessment methodologies, please contact Walden by calling (516) 701-1681.

Sources and Cites: