For most Long Island homeowners living in flood zones, recent updates to the Federal Flood Insurance Program have dramatically increased flood insurance rates. The revised program has been developed over a number of years, but officially went into effect in October 2021.

Since 1968, FEMA’s National Flood Insurance Program has calculated flood insurance premiums by considering a few key factors: the property’s flood zone, elevation, and how the property is utilized (investment, primary or secondary property). The rates collected have not been enough to cover flood damages for a number of years, causing the program to be in deficit, requiring taxpayer funds to cover the difference. In an aim to use less taxpayer funds to cover flood relief and bring more equity to existing flood insurance rates, the program was completely revamped. The updated criteria is expected to significantly raise flood insurance rates for many homeowners, doubling or tripling premiums for some.

The following updated criteria are now factored in when determining new insurance premiums:

- The property’s distance to a flood source

- The height of the building’s first floor

- How much it would cost to replace the property

- The twenty-year flood claim history of the property

This means that insurance premiums can vary greatly from home to home, even for properties located in the same neighborhood.

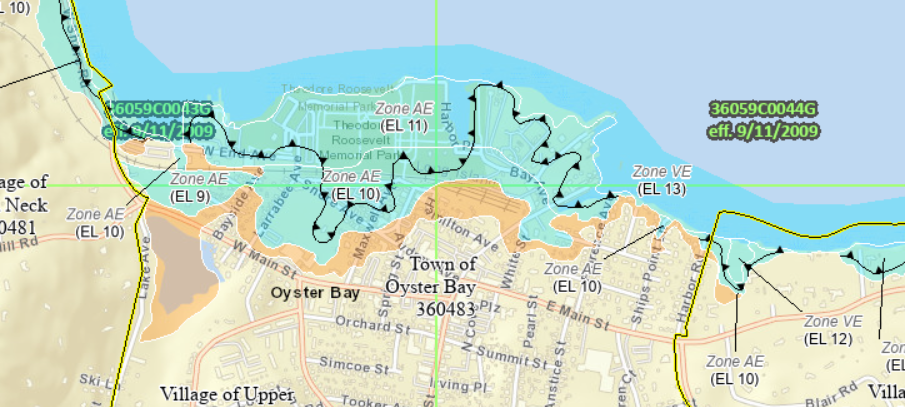

Long Island has three main flood zones: Zone X (low risk – 0.2% Annual Chance Flood Hazard (ACFH) or less than 1ft depth), Zone AE (high risk – 1% ACFH), and Zone VE (coastal high risk – 1% ACFH plus wave hazard). Homeowners living in Zone X are not required to purchase flood insurance, but for those who opt for the extra protection, Zone X flood insurance rates in the past averaged around $500 a year. These rates have gone up about 200 percent, and can now be expected to cost $1,500 a year. Premiums in the higher-risk zones, where banks will require homebuyers to purchase flood insurance, can cost up to several thousand dollars a year.

Homeowners with existing flood insurance policies won’t see a change in their rates until the spring of 2022. Since rates can only increase 18% annually, the full impact of this new program may not hit them all at once, but rates will likely continue to increase annually until the new premiums are achieved. However, for those homeowners who never had flood insurance and do not possess an existing policy, the new criteria could create a significant cost. Since flood insurance is an ongoing cost and not something you can pay off, new insurance premiums are likely to affect the Long Island housing market in some flood zone areas.

FEMA is currently seeking comments regarding the National Flood Insurance Program’s minimum floodplain management standards. The comment period has been extended to Jan 27, 2022.

How can municipalities reduce insurance rates for their residents? By entering the Community Rating System (CRS) program, and demonstrating tangible actions to reduce flood impacts across the community, a municipality can collectively get discounts on insurance for its residents. This will be worth more to the community and its residents moving forward as rates increase. Walden has experience in implementing CRS programs and can assist your municipality to achieve real discounts on rates, which is something everyone in a community should support. Please call Walden on 516 624 7200 to speak to a member of our team that assist.