What is Special Flood Hazard Area (SFHA)?

According to the United States Federal Emergency Management Agency (FEMA), a Special Flood Hazard Area (SFHA) is an area which is subject to flood events equal to or surpassing the 1% annual chance flood. The National Flood Insurance Program (NFIP) floodplain management regulations are enforced in SFHA zones. Owners of properties located in a SFHA zone are required to purchase flood insurance. The SFHA zone classifications include A, AO, AH, A1-30, AE, A99, AR, AR/A1-30, AR/AE, AR/AO, AR/AH, AR/A, VO, V1-30, VE, and V.

Definition of Community Rating System (CRS)

General property insurance does not cover damages caused by flooding. Flood insurance is provided through the NFIP, which is managed by FEMA. The Community Rating System (CRS) is a voluntary NFIP program which reduces flood insurance premiums for properties in eligible communities. The CRS program recognizes and rewards communities that apply for the program and document activities to meet the minimum standards established by the NFIP. Discounts on flood insurance premiums range from 5% to 45% based on the CRS points achieved by the community.

Benefits of CRS Participation

According to the CRS Coordinator’s Manual, CRS provides credit for 19 public information and floodplain management activities. The activities which are credited by CRS increase public safety by decreasing flood damage and promoting environmental protection activities. Residents feel safer as their community is actively taking steps to reduce flood losses. Public information activities for CRS will accelerate future flood protection plans.

CRS rates communities on a ranking from 1 to 10 depending on the credit points earned through the application process. To qualify for the top ranking (Rank 1), a community would have to earn a minimum of 4,500 points, which would result in the maximum 45% discount on flood insurance premiums. A community applying for participation in the CRS program has to earn at least 500 points to qualify and attain the minimum possible flood insurance discount (5%). Communities do not have to be located in a SFHA zone to qualify for the CRS; those located outside SFHA zone are also eligible for the CRS, with possible discounts up to 10 percent. Additional CRS credit is also earned for evaluating future flood conditions and considering how factors including future development, urbanization and changing weather patterns might impact flooding.

Communities in the CRS also realize some non-financial benefits from participation in the program. These benefits include recognition for going above and beyond to implement community programs related to flooding issues. In addition, CRS communities can technical assistance in design and implementation from Insurance Services Office (ISO) free of cost.

The activities which are credited by CRS, increase public safety by decreasing flood damage and environmental protection. Residents feel safer as their community is taking care of the flood losses. Public Information activities for CRS will accelerate flood protection measurement plans for future.

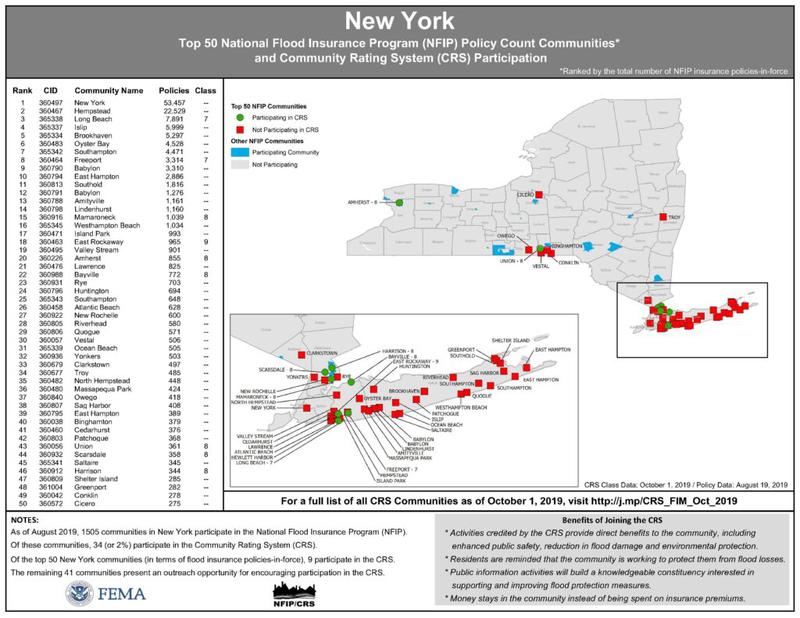

New York State Participation in CRS Program

A total of 1,497 communities in New York State participate in the NFIP program. Of this total, only 29 communities participate in the CRS program. Only 10 communities among the top 50 (based on number of NFIP flood insurance policies) are in the CRS program. Therefore, many eligible communities throughout New York State should consider applying for the CRS in order to take advantage of the program benefits and save property owners a significant amount on flood insurance premiums.

How to Apply for CRS Credits

If your community is in full compliance with the rules and regulations of the NFIP, you can apply for voluntary participation in the CRS program. The community has to submit a letter of interest to the FEMA regional office with documentation of proof to attain at least 500 points towards the CRS rating. Documentation must also be provided to verify the measures your community is taking to earn credits.

Walden Can Help Your Community Apply for the CRS

Call Walden to discuss the benefits of the CRS program and to learn how we can help you apply and achieve the maximum points based on your community’s activities. It is possible that the you are already implementing programs that satisfy many of the conditions needed to earn CRS credits so you can lower flood insurance premiums for local property owners.